Contents:

Provisions ascribed to impairment of particular assets or known liabilities should be excluded. To determine the amount of expected deferred-tax assets realizable in the next 12 months, an institution should assume that all existing temporary differences fully reverse as of the report date. Projected future taxable income should not include net operating loss carry-forwards to be used during that year or the amount of existing temporary differences a bank holding company expects to reverse within the year.

The transition period for implementing the risk-based capital standard ends on December 31, 1992. Initially, the risk-based capital guidelines do not establish a minimum level of capital. However, by year-end 1990, banking organizations are expected to meet a minimum interim target ratio for qualifying total capital to weighted risk assets of 7.25 percent, at least one-half of which should be in the form of Tier 1 capital. For purposes of meeting the 1990 interim target, the amount of loan loss reserves that may be included in capital is limited to 1.5 percent of weighted risk assets and up to 10 percent of an organization’s Tier 1 capital may consist of supplementary capital elements. Thus, the 7.25 percent interim target ratio implies a minimum ratio of Tier 1 capital to weighted risk assets of 3.6 percent (one-half of 7.25) and a minimum ratio of core capital elements to weighted risk assets ratio of 3.25 percent (nine-tenths of the Tier 1 capital ratio). Under generally accepted accounting principles, the trust issuing the preferred securities generally is not consolidated on the banking organization’s balance sheet; rather the underlying subordinated note is recorded as a liability on the organization’s balance sheet.

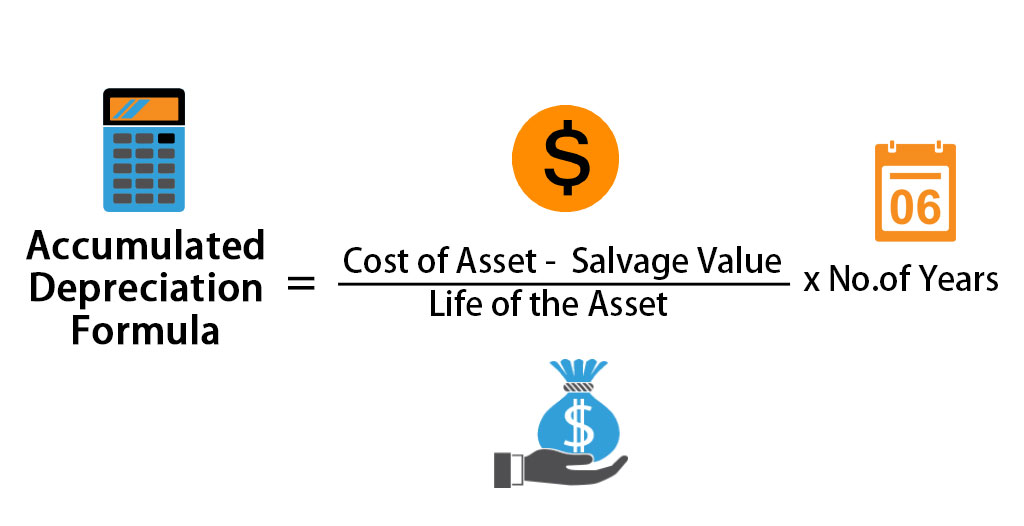

As of June 30, 2021, the System consists of 3 Farm Credit Banks, 1 agricultural credit bank, 66 agricultural credit associations, 1 Federal land credit association, service corporations, and the Federal Farm Credit Banks Funding Corporation . The System’s enabling statute is the Farm Credit Act of 1971, as amended . A revaluation reserve is a reserve created when a company has an asset revalued and an increase in value is brought to account. A simple example is the situation where a bank owns the land and building of its head-offices and bought the properties for $100 a century ago. A current revaluation is likely to reflect a large increase in value. The increase would be added to a revaluation reserve.

The bank’s ECL for a wholesale exposure to a defaulted obligor or a defaulted retail segment is equal to the bank’s impairment estimate for ALLL purposes for the exposure or segment. Statutory minimum borrower stock is stock acquired by System borrowers to satisfy requirements under Section 4.3A of the Act. It is equal to the lesser of $1,000 or 2 percent of the loan. Shall not call, difference between tier 1 and tier 2 capital redeem, revolve, cancel, or remove any equities included in tier 2 capital without prior approval of the FCA under paragraph of this section. In order to recognize an exposure as an eligible margin loan for purposes of this subpart, a System institution must comply with the requirements of § 628.3 with respect to that exposure. FCA received seven comment letters on the proposed rule.

PART 615—FUNDING AND FISCAL AFFAIRS, LOAN POLICIES AND OPERATIONS, AND FUNDING OPERATIONS

Revising the definitions of “Eligible margin loan”, “Qualifying master netting agreement”, “Repo-style transaction”, and “System institution”. Under the Accord, the riskier a bank’s portfolio, the more capital it would be required to hold. If you intend a substantial capital raise, you may find that marketing your offering in only a few States will be too limiting, so you will need to promote your offering to investors all over the USA, and Tier 2 is best. Tier 1permits capital raises of up to $20 million per year from individual “Main Street” investors, and of course, from accredited investors and institutions worldwide.

Higher capital ratios could be required if warranted by the particular circumstances or risk profiles of individual banking organizations. In all cases, organizations should hold capital commensurate with the level and nature of all of the risks, including the volume and severity of problem loans, to which they are exposed. Once a commitment has been converted at 50 percent, any portion that has been conveyed to U.S. depository institutions or OECD banks as participations in which the originating banking organization retains the full obligation to the borrower if the participating bank fails to pay when the instrument is drawn, is assigned to the 20 percent risk category.

What Is Tier 3 Capital?

Under Basel III, a bank’s tier 1 and tier 2 assets must be at least 10.5% of its risk-weighted assets. Loans that qualify as loans secured by 1- to 4-family residential properties or multifamily residential properties are listed in the instructions to the FR Y–9C Report. Risk-weighted assets for the third and fourth quarters. A banking organization that excludes assets of consolidated VIEs from risk-weighted assets pursuant to section IV.C.1.a. Qualifying total capital is calculated by adding Tier 1 capital and Tier 2 capital and then deducting from this sum certain investments in banking or finance subsidiaries that are not consolidated for accounting or supervisory purposes, reciprocal holdings of banking organizations’ capital securities, or other items at the direction of the Federal Reserve. The conditions under which these deductions are to be made and the procedures for making the deductions are discussed above in section II.

Institutions with high or inordinate levels of risk are also expected to operate above minimum capital standards. In all cases, institutions should hold capital commensurate with the level and nature of the risks to which they are exposed. Banking organizations that do not meet the minimum risk-based standard, or that are otherwise considered to be inadequately capitalized, are expected to develop and implement plans acceptable to the Federal Reserve for achieving adequate levels of capital within a reasonable period of time. Long-term preferred stock with an original maturity of 20 years or more will also qualify in this category as an element of tier 2 capital. If the holder of such an instrument has the right to require the issuer to redeem, repay, or repurchase the instrument prior to the original stated maturity, maturity would be defined for risk-based capital purposes as the earliest possible date on which the holder can put the instrument back to the issuing banking organization. In the last five years before the maturity of the stock, it must be treated as limited-life preferred stock, subject to the amortization provisions and quantitative restrictions set forth in sections II.A.2.d.iii.

- Finally and most importantly, as previously discussed in the preamble to the 2017 Capital Rule, the redemptions we allow must be considered in the context of our overall limitations on capital distributions.

- Amend the requirement to adopt an annual board resolution with respect to prior approval requirements and the minimum holding periods for certain equities included in CET1 or tier 2 capital.

- The agencies note that investments in unconsolidated banking and finance subsidiaries and reciprocal holdings of bank capital instruments would continue to be deducted from regulatory capital as described in the general risk-based capital rules.

- To the extent permitted by law or regulation, performance standby letters of credit include arrangements backing, among other things, subcontractors’ and suppliers’ performance, labor and materials contracts, and construction bids.

Typically, it holds nearly all of the bank’s accumulated funds. These funds are generated specifically to support banks when losses are absorbed so that regular business functions do not have to be shut down. Cumulative preference shares, having the above characteristics, would be eligible for inclusion in tier 2 capital.

Undisclosed reserves must be accepted by the bank’s supervisory authorities. Many countries do not accept undisclosed reserves as an accounting concept or as a legitimate form of capital. The result of the formula is a percentage. Basel III is a set of reform measures intended to improve regulation, supervision, and risk management in the international banking sector. Unsecured, subordinated debt makes up tier 3 capital and is of lower quality than tier 1 and tier 2 capital. AT1 bonds are popular among European banks as a way to build up safety buffers.

Post Offering Reporting Requirements

Under the proposed rule, a bank’s total qualifying capital is the sum of its tier 1 capital elements and tier 2 capital elements, subject to various limits and restrictions, minus certain deductions . The agencies are not restating the elements of tier 1 and tier 2 capital in this proposed rule. Those capital elements generally remain as they are currently in the general risk-based capital rules.30 The agencies have provided proposed regulatory text for, and the following discussion of, proposed adjustments to the capital elements for purposes of the advanced approaches. In response to the ABA’s concerns regarding the Safe Harbor giving inadequate consideration to an institution’s risk profile, the commenter’s assertion that the Safe Harbor permits “cash payouts based only on maintaining the dollar amount of CET1 capital in a prior year” is incorrect. As we stated in the preamble to the proposed rule, in order to make a cash distribution under the Safe Harbor, a System institution must remain in compliance with all regulatory capital requirements and any supervisory or enforcement actions after such distribution. FCA’s regulatory capital requirements are comparable to the U.S.

Goodwill and other intangible assets—a. Goodwill is an intangible asset that represents the excess of the cost of an acquired entity over the net of the amounts assigned to assets acquired and liabilities assumed. Goodwill is deducted from the sum of core capital elements in determining tier 1 capital. Nonfinancial equity investments—portions are deducted from the sum of core capital elements in accordance with section II.B.5 of this appendix A. The instrument must be available to participate in losses while the issuer is operating as a going concern. (Term subordinated debt would not meet this requirement.) To satisfy this requirement, the instrument must convert to common or perpetual preferred stock in the event that the accumulated losses exceed the sum of the retained earnings and capital surplus accounts of the issuer.

This would satisfy the requirement to refer to parts 615 and 628 and would include all existing capital requirements of the FCA as well as any future capital requirements that we may adopt in other parts of our regulations. FCL’s ownership status were to change in the future, we will reassess whether to separately apply our regulatory capital requirements. We disagree with the assertion that the proposal would “liberalize” the Safe Harbor.

Such contingencies generally include commercial letters of credit and other documentary letters of credit collateralized by the underlying shipments. Revolving underwriting facilities , note issuance facilities , and other similar arrangements also are converted at 50 percent regardless of maturity. These are facilities under which a borrower can issue on a revolving basis short-term paper in its own name, but for which the underwriting organizations have a legally binding commitment either to purchase any notes the borrower is unable to sell by the roll-over date or to advance funds to the borrower. The subordinated debt must not have credit-sensitive features or other provisions that are inconsistent with safe and sound banking practice. The instrument must be unsecured; fully paid-up and subordinated to general creditors.

Regulation A+ Tier 1 vs Tier 2 Offerings

System institution for the purposes of this subpart. Any other risk-oriented activities, such as funding and interest rate risks, potential obligations under joint and several liability, contingent and off-balance-sheet liabilities or other conditions warranting additional capital. The System Comment Letter and AgriBank, FCB , also requested that we consider changes to the definition of UREE in § 628.2 if we retain the URE requirement. As discussed in Section 2—Substantive Revisions to the Capital Rule and Section 3—Clarifying and Other Revisions to the Capital Rule, the final rule adopts the revisions we proposed with minor adjustments in response to comments received. The OFR/GPO partnership is committed to presenting accurate and reliable regulatory information on FederalRegister.gov with the objective of establishing the XML-based Federal Register as an ACFR-sanctioned publication in the future.

Tier 2 capital is supplementary, i.e., less reliable than tier 1 capital. A bank’s total capital is calculated as a sum of its tier 1 and tier 2 capital. Regulators use the capital ratio to determine and rank a bank’s capital adequacy. Tier 3 capital consists of subordinated debt to cover market risk from trading activities. —Investments in and lending of a capital nature to unconsolidated subsidiaries engaged in banking and financial activities.

The Federal Reserve will continue to require bank holding companies to maintain reserves at levels fully sufficient to cover losses inherent in their loan portfolios. The reported amount of deferred-tax assets, net of any valuation allowance for deferred-tax assets, in excess of the lesser of these two amounts is to be deducted from a banking organization’s core capital elements in determining tier 1 capital. There generally is no limit in tier 1 capital on the amount of deferred-tax assets that can be realized from taxes paid in prior carry-back years or from future reversals of existing taxable temporary differences.

Treasury securities, have a 0 percent risk-weighted capital requirement. In contrast, claims on commercial companies and real estate investments have a 100 percent risk weight. For additional detail, see pages 21-22, International Convergence of Capital Measurement and Capital Standards, . Tier 1 capital is intended to measure a bank’s financial health; a bank uses tier 1 capital to absorb losses without ceasing business operations.

Transaction-related contingencies are converted at 50 percent. Such contingencies include bid bonds, performance bonds, warranties, standby letters of credit related to particular transactions, and performance standby letters of credit, as well as acquisitions of risk participation in performance standby letters of credit. Peformance standby letters of credit represent obligations backing the performance of nonfinancial or commercial contracts or undertakings. To the extent permitted by law or regulation, performance standby letters of credit include arrangements backing, among other things, subcontractors’ and suppliers’ performance, labor and materials contracts, and construction bids. Sale and repurchase agreements and forward agreements.

The internal credit risk system must make credit risk rating assumptions that are consistent with, or more conservative than, the credit risk rating assumptions and methodologies of NRSROs. Liquidity Facility means a legally binding commitment to provide liquidity support to ABCP by lending to, or purchasing assets from, any structure, program, or conduit in the event that funds are required to repay maturing ABCP. 1 Requirements for the deduction of other intangible assets and residual interests are set forth in section II.B.1. The Board will monitor the implementation and effect of these guidelines in relation to domestic and international developments in the banking industry. When necessary and appropriate, the Board will consider the need to modify the guidelines in light of any significant changes in the economy, financial markets, banking practices, or other relevant factors.

The acceptable amount of Tier 2 capital held by a bank is at least 2%, where the required percentage for Tier 1 capital is 6%. Tier 2 Capital is known a bank’s supplementary capital. This is capital that is seen as being of a higher risk than its Tier 1 core capital partners. The capital that falls within the definition of Tier 2 is revaluation reserve, undisclosed reserves, and subordinate debt. Revaluation reserve is capital earned when the revaluation of an asset leads to it gaining value compared to its previously determined value.

All servicing assets, including servicing assets on assets other than mortgages (i.e., nonmortgage servicing assets), are included in this appendix as identifiable intangible assets. The only types of identifiable intangible assets that may be included in, that is, not deducted from, an organization’s capital are readily marketable mortgage servicing assets, nonmortgage servicing assets, and purchased credit https://1investing.in/ card relationships. The total amount of these assets that may be included in capital is subject to the limitations described below in sections II.B.1.d. Consistent with long-standing supervisory practice, the excess of market values over book values for assets held by bank holding companies will generally not be recognized in supplementary capital or in the calculation of the risk-based capital ratio.

Lascia un commento